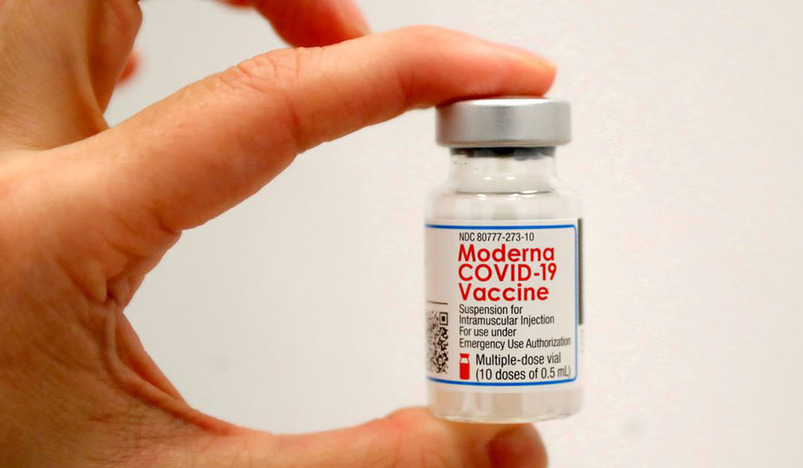

A healthcare worker holds a vial of the Moderna COVID-19 Vaccine at a pop-up vaccination site operated by SOMOS Community Care during the coronavirus disease (COVID-19) pandemic in Manhattan in New York City

Debate over the need for COVID-19 booster shots is clouding the outlook for Moderna Inc's (MRNA.O) high-flying shares after the U.S. biotechnology company's stock price soared as much as 360% this year, making it the best performer in the S&P 500.

Investors on Friday were awaiting comments from a panel of outside experts, which is weighing whether to recommend if U.S regulators should approve Pfizer (PFE.N) and partner BioNTech's application for an extra round of shots for their vaccine. Moderna, whose vaccine is based on a similar messenger RNA (mRNA) technology, applied earlier this month to allow use of a booster dose, but that is not expected to be taken up in Friday's meeting.

Moderna has benefited from being one of the dominant coronavirus vaccines, but its shares have pulled back more than 10% since hitting a closing high of $484.47 in early August. One factor in the rally stalling, analysts said, is a muddier outlook for additional booster COVID-19 shots, on top of the initial two-dose regimen.

“When (the stocks) ran up, I think it was expecting a booster shot to be given to everyone,” said Jeff Jonas, a portfolio manager at Gabelli Funds. "Now I think it’s maybe a little less certain that that extra demand is going to be there.”

The U.S. government has said it plans to start offering booster shots widely as soon as next week. But experts have questioned whether there is evidence to back such a plan.

This week, leading scientists, including two departing U.S. Food and Drug Administration officials, said in an influential medical journal that additional booster shots are not needed for the general population.

In a note this week, SVB Leerink analysts estimated that the booster market is likely to add another $3 billion to $4 billion in U.S. revenue potential for existing vaccines.

Substantial booster revenue for the companies "are already contemplated in consensus estimates," the Leerink analysts said, "making the stock impact for Moderna in particular dependent on the breadth of the recommended population and boosting interval."

An already powerful rally in Moderna shares went into overdrive this summer, as index fund managers were forced to buy the stock after it was added to the S&P 500, and as concerns rose over a resurgence in COVID-19 cases due to spread of the virulent Delta variant of the virus.

The stock has been volatile since joining the index in mid July, with Moderna shares being either the biggest daily percentage gainer or loser in the S&P 500 in 10 trading days since the stock joined - a quarter of all the sessions over that time.

Analysts overall appear to be cautious about the stock, even as the company is developing other products, including a vaccine that combines a booster dose against COVID-19 with its experimental flu shot.

The median price target for Moderna shares among 12 analysts is $391, according to Refinitiv, over 11% below Thursday's closing price of $440.65

Using earnings estimates for the next 12 months, Moderna shares trade at a price-to-earnings ratio of 15.8, according to Refinitiv Datastream. That is more expensive than the 11.4 times P/E of S&P 500 biotech companies overall, but cheaper than the 17.7 of the S&P 500 healthcare sector (.SPXHC).

However, Moderna is also trading at about 15 times estimates of its sales in five years - a valuation level that large biotech stocks with one key product have peaked at historically, according to Hartaj Singh, a biotech analyst at Oppenheimer. Singh downgraded his rating on the stock to "neutral" in August.

"I don’t expect the stock to go down unless there is some unequivocal bad news that comes across," Singh said. "But I do think that a lot of the good news is already in the stock valuation."

REUTERS / Reporting by Lewis Krauskopf; Editing by Ira Iosebashvili and Bill Berkrot

.jpg)

Qatar Secures Place Among the World's Top 10 Wealthiest Nations

.jpg)

Hamad International Airport Witnesses Record Increase in Passenger Traffic

Saudi Arabia: Any visa holder can now perform Umrah

What are Qatar's Labour Laws on Annual Leave?

Leave a comment